CBI vs RBI in 2026 – Which Is Better for Investors

جدول المحتويات

Over the past year, we noticed something interesting in conversations with investors.

Earlier, the question was simple. Which country should I move to?

In 2026, the question sounds very different. How permanent should my move be?

That single shift explains why the discussion around CBI vs RBI has become so important. Investors are no longer choosing locations alone. They are choosing outcomes. Some want finality and certainty. Others want flexibility and time. Citizenship by Investment and Residency by Investment sit at opposite ends of that decision.

Understanding CBI vs RBI is no longer optional for globally minded investors. It is a strategic decision that affects mobility, family planning, business expansion, and long-term security.

Earlier, the question was simple. Which country should I move to?

In 2026, the question sounds very different. How permanent should my move be?

That single shift explains why the discussion around CBI vs RBI has become so important. Investors are no longer choosing locations alone. They are choosing outcomes. Some want finality and certainty. Others want flexibility and time. Citizenship by Investment and Residency by Investment sit at opposite ends of that decision.

Understanding CBI vs RBI is no longer optional for globally minded investors. It is a strategic decision that affects mobility, family planning, business expansion, and long-term security.

Citizenship by Investment (CBI)

برامج CBI are built for investors who prefer decisive outcomes. Once approved, there is no waiting period to “become” something later. The result is immediate and clear.

This is why many investors exploring global options naturally look at the best countries for citizenship by investment. These programs are often found in jurisdictions that understand investor needs and have streamlined application processes.

Once citizenship is granted:

In the CBI vs RBI debate, this sense of permanence is often the strongest deciding factor.

This is why many investors exploring global options naturally look at the best countries for citizenship by investment. These programs are often found in jurisdictions that understand investor needs and have streamlined application processes.

Once citizenship is granted:

- There is no dependency on renewals.

- There is no requirement to justify continued presence.

- Rights are not conditional.

In the CBI vs RBI debate, this sense of permanence is often the strongest deciding factor.

- Unlike residency routes, CBI programs grant full citizenship within a clearly defined timeframe, typically ranging from 3 to 12 months, depending on the country, application volume, and due diligence process.

- Once the application is approved and the qualifying investment is completed, applicants receive citizenship directly, without the need for long-term residence or repeated renewals.

- Successful applicants receive a جواز سفر ثانٍ and enjoy the same legal rights as native-born citizens, including the ability to pass citizenship on to future generations.

- This combination of a short timeline and permanent status makes CBI particularly attractive for individuals seeking long-term global mobility, asset diversification, and strategic security.

CBI Countries Offering Strong Global Mobility

The following Citizenship by Investment programs are commonly chosen by investors due to their established frameworks, transparent processes, and international travel access.

Residency by Investment (RBI)

RBI programs appeal to a different mindset. These are investors who prefer to keep options open. برامج الإقامة عن طريق الاستثمار are often chosen by individuals who want international access without changing their nationality immediately.

Instead of offering a second passport upfront, these programs provide legal residency status, allowing investors and their families to establish a presence in another country while retaining their original citizenship.

Instead of offering a second passport upfront, these programs provide legal residency status, allowing investors and their families to establish a presence in another country while retaining their original citizenship.

- Residency allows individuals to relocate gradually. It provides access to infrastructure, education, healthcare, and business ecosystems without the immediate commitment of nationality. This is where golden visa residency benefits play an important role.

- For many, residency feels safer at the start. It allows them to test a country before making deeper commitments. It also suits investors who already hold strong passports and do not urgently need a second citizenship.

- However, residency always comes with conditions. Renewals, physical presence rules, and policy changes can affect long-term outcomes. This is not a drawback. It is simply the nature of the structure.

- Residency by Investment is often valued for its flexibility. Residency status typically comes with the right to live in the country and, in many cases, to work, study, or operate a business.

- Most programs are renewable and structured around long-term compliance rather than instant outcomes. This makes RBI suitable for investors who are planning gradual relocation, lifestyle changes, or regional expansion over time.

RBI Programs Commonly Preferred by Investors

The following residency programs are frequently selected due to their regulatory clarity, regional access, and long-term planning advantages:

- Portugal Golden Visa – Popular for its structured path toward permanent residency and eventual citizenship within the EU.

- Greece Golden Visa – Known for straightforward residency rights and access to the Schengen Area.

- UAE Golden Visa – Favored for its long-term residency security and tax-friendly environment.

- Malta Residency – Preferred for its clear investment structure, Schengen mobility, and strong foundations for long-term residence within the EU.

- Latvia Golden Visa – Offers a cost-efficient entry point into EU residency with business flexibility.

Differences between CBI and RBI programs

At a glance, CBI and RBI look similar. Both involve an investment. Both involve government approval. Both offer legal status in another country. But the similarities end there.

The real differences between CBI and RBI programs lie in what happens after approval.

CBI delivers an immediate change in legal identity. You become a citizen. You receive a passport. Your status is permanent from day one.

RBI, on the other hand, delivers permission. Permission to live. Permission to stay. Sometimes, permission to work or do business. Citizenship, if available at all, comes later and depends on time, compliance, and policy stability. This difference shapes everything that follows.

The real differences between CBI and RBI programs lie in what happens after approval.

CBI delivers an immediate change in legal identity. You become a citizen. You receive a passport. Your status is permanent from day one.

RBI, on the other hand, delivers permission. Permission to live. Permission to stay. Sometimes, permission to work or do business. Citizenship, if available at all, comes later and depends on time, compliance, and policy stability. This difference shapes everything that follows.

Second Citizenship vs Golden Visa: A Decision of Intent

أ جواز سفر ثانٍ and a golden visa serve different purposes.

For this reason, the right solution depends entirely on the investor’s objectives.

- A second citizenship is about independence. It reduces reliance on a single country. It offers security during political or economic uncertainty. It simplifies long-term planning.

- A golden visa is about access. It provides entry into a region. It offers lifestyle advantages. It supports gradual relocation.

For this reason, the right solution depends entirely on the investor’s objectives.

Global Mobility in 2026: How Investors Actually Travel

Mobility is often discussed in numbers, but investors experience it in practice.

- Citizenship-based mobility is generally understood in terms of passport access. Many established Citizenship by Investment passports provide visa-free or visa-on-arrival access to more than 150 destinations worldwide, covering approximately 75–80% of globally recognized travel jurisdictions.

- Residency-based mobility works differently. It is location-driven rather than passport-driven. A European residency may allow seamless travel within the Schengen Area, but travel beyond that region still depends on the original passport.

- Business owners flying across continents

- Families managing international education

- Investors attending meetings without visa delays

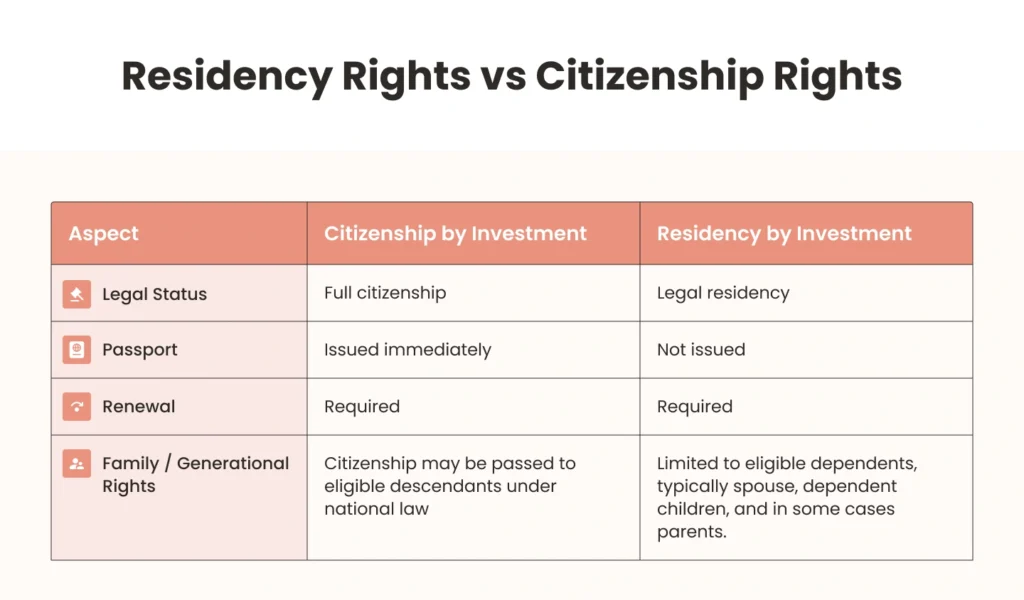

Residency Rights vs Citizenship Rights: A Clear Contrast

The distinction between rights becomes clearer when viewed side by side.

This table alone explains why some investors want certainty while others prefer adaptability.

From Residency to Citizenship: The Long Game

Many investors choose RBI with the hope of citizenship later. This is where expectations must be realistic.

The RBI path to permanent residency and citizenship is rarely automatic. It depends on:

For investors who value patience and long-term integration, this route can work well.

The RBI path to permanent residency and citizenship is rarely automatic. It depends on:

- Length of stay

- Compliance history

- Language or integration requirements

- Policy continuity

For investors who value patience and long-term integration, this route can work well.

How High-Net-Worth Investors Are Deciding in 2026

In 2026, patterns are clear. Entrepreneurs with global operations often lean toward citizenship for simplicity and mobility.

Families planning future education and lifestyle changes often begin with residency. Investors managing geopolitical risk often choose CBI for certainty.

This diversity of choice is exactly why the decision remains highly individualized rather than universally defined.

Families planning future education and lifestyle changes often begin with residency. Investors managing geopolitical risk often choose CBI for certainty.

This diversity of choice is exactly why the decision remains highly individualized rather than universally defined.

Final Perspective: Choosing Between CBI and RBI

The real question is not which program is better. The real question is what kind of future you are building.

CBI suits investors who want closure, security, and immediate global mobility. RBI suits investors who want flexibility, regional access, and time.

When understood properly, CBI vs RBI is not a competition. It is a choice between two valid strategies, each designed for a different investor mindset.

CBI suits investors who want closure, security, and immediate global mobility. RBI suits investors who want flexibility, regional access, and time.

When understood properly, CBI vs RBI is not a competition. It is a choice between two valid strategies, each designed for a different investor mindset.

How UNO Capital Helps Investors Navigate Decisions

Choosing between citizenship and residency is rarely straightforward. In most cases, investors are not confused about the options. They are uncertain about the consequences. This is where experienced guidance makes a real difference.

- أونو كابيتال works closely with investors to understand not just where they want access, but why they want it. Every recommendation begins with clarity around long-term goals, family planning, mobility needs, and risk tolerance. This ensures that the decision between CBI and RBI is aligned with strategy, not urgency.

- Each program is evaluated based on government regulations, approval track records, and long-term stability. Investors are guided through realistic timelines, legal requirements, and documentation expectations, so there are no surprises later in the process.

- From coordinating with authorized agents to managing due diligence and post-approval formalities, the process remains streamlined and transparent. Whether an investor is pursuing immediate citizenship or a gradual residency pathway, the approach remains consistent, structured, and discreet.

Most importantly, UNO Capital does not promote one route over the other. The role is advisory. The objective is to help investors make informed, confident decisions that support their future mobility, security, and legacy planning

اتصل بنا اليوم!

المشاركات الاخيرة

مؤلف